As the Fairfax deal ends and Heins heads out, an investment is now on the table.

BlackBerry Ltd. is making top technology news as it is now abandoning its previous strategy to seek out a buyer and has now chosen to raise $1 billion in new funds, while it replaces some of its directors, as well as its CEO.

The company had previously received a letter of intent from Fairfax Financial Holdings, Ltd. for purchase.

That technology news was made very shortly after BlackBerry had released its most recent figures and that it was seeking a buyer in earnest. It would have bought the company for $4.7 billion. Fairfax was given until Monday to complete its full examination of the books at the Waterloo, Canada based suffering tech giant.

The new intention making this technology news is the intention to sell convertible notes.

The new intention making this technology news is the intention to sell convertible notes.

These notes will be sold to a group of investors in order to help BlackBerry to raise $1 billion, say people who are familiar with this technology news. Moreover, Thorsten Heins, the chief executive officer will be leaving the company, while considerable changes will be made to its board of directors.

Heins had risen to his position, making technology news early last year. He took over this position from Jim Balsillie and Mike Lazaridis, who had been leading the company since very early on in its existence.

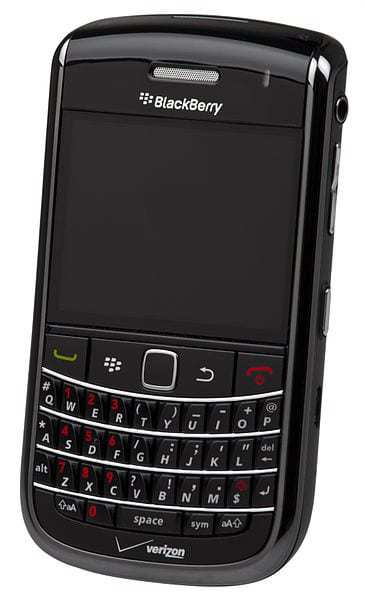

Heins’ time as CEO was deeply wounded by the latest phone lineup launch of the company. At best, the reception to the latest line of smartphones from BlackBerry was tepid. This caused the company to decide to officially put itself up for sale as of August.

In the Fairfax deal, which is no longer being considered, an offer of $9 per share was on the table, making tremendous technology news. It involved the bringing together of a group of investors. There was considerable skepticism that the deal would be successfully completed and BlackBerry’s shares have been traded considerably lower than that amount. There were a number of interested parties drawn to this deal, including Lazaridis, Cerberus Capital Management, and Qualcomm Inc.