Recent research by analysts showed that there were 82.5 million users of Peer-to-Peer payments in the US in 2018.

To make this figure seem even more huge, let’s say that this is almost a third of the US population that uses mobile devices. And in 2022, the number of users of P2P payments should grow to 52%. This rapidly growing popularity is causing many entrepreneurs to consider building their own P2P payment applications. In this article, we will show you how to create your own P2P payment application complying with all security protocols and legal compliances. Without further ado, let’s get started.

What Are Peer-to-Peer Payment Apps

First off, let’s deal with the basics. In simple terms, P2P payments are transactions made online from one mobile application to another. Paying in this way can cover a fairly wide range of services, whether it be renting a car, dining at a restaurant, or taking a taxi.

There are several types of such applications:

- Banking services. Most modern banks already have such features in their arsenal. For example, Dwolla and Zelle allow P2P bank payments.

- Discrete services. At their core, these are electronic wallets. PayPal or Venmo QR Codes are a great example.

- Social platforms. Some popular messengers support money transactions directly from the application interface, for example, WhatsApp.

- Mobile OS systems. This is one of the most common types, including Android Pay and Apple Pay.

Must-Have Features for P2P Payment App

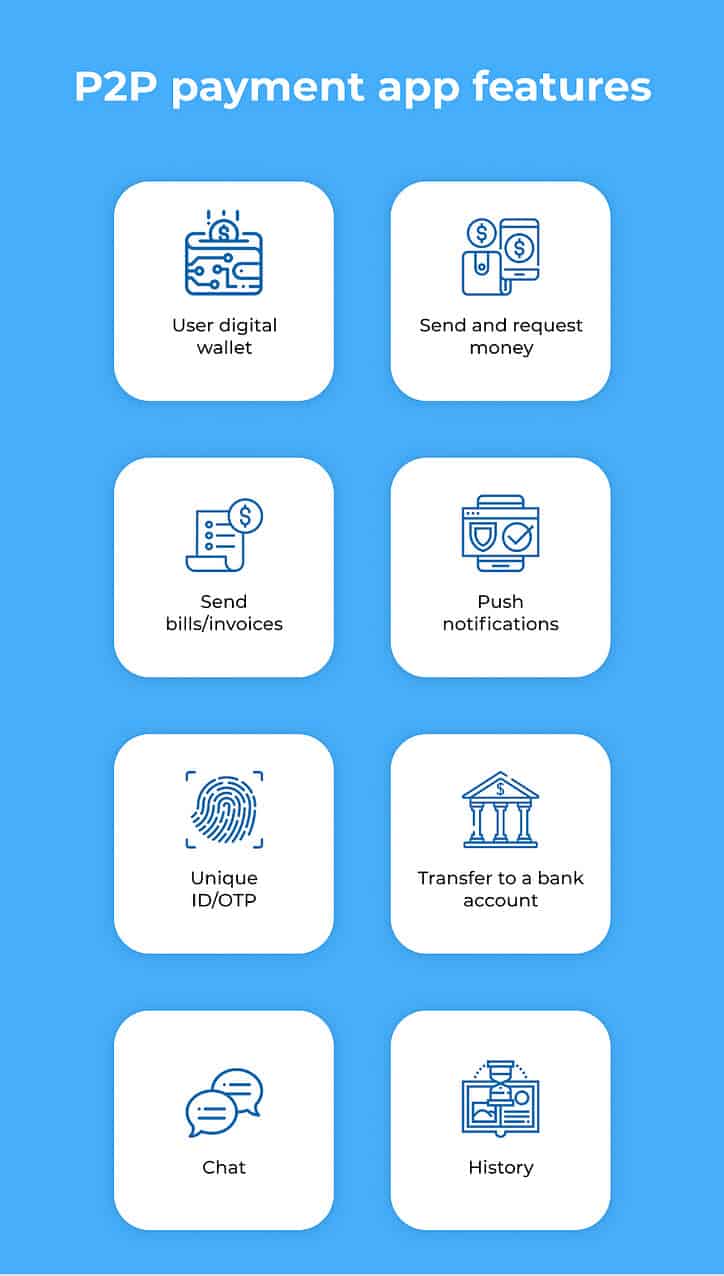

Before you start thinking about your P2P application, you should know about the most basic features of such applications.

- User wallet. This feature is the basis of all such applications. With the help of it, the users can store their funds and also make various payments.

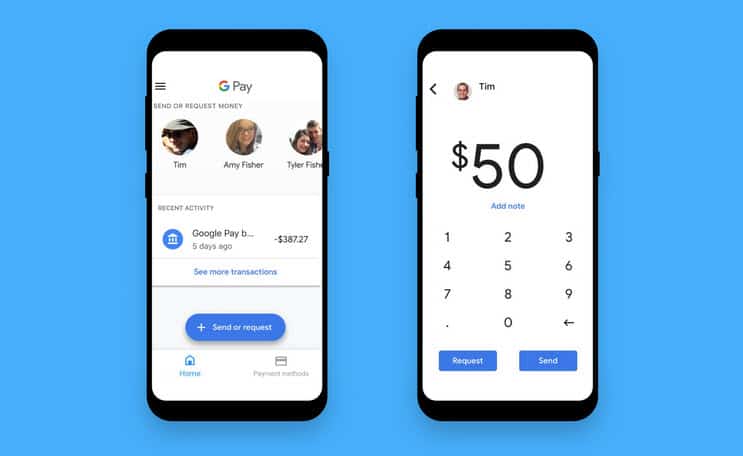

- Money request/Send money. Another feature that no P2P application can do without. The user can send money or a request to send a certain amount of money.

- Bills and invoices. To control funds, it is very important to add the ability to scan different accounts with the camera. In addition, the ability to create your own invoices is required.

- Push notifications. Everything is pretty simple here. Every time a user receives a money transfer or an invoice, the application must notify the user about this using push notifications.

- ID and OTP. Security measures are everything. Before the user can use the application, you need to verify and confirm the user’s unique ID and OTP or one time password.

- Transfer to a bank account. Users should be able to transfer money to their bank accounts or cards.

- Transaction history. For a simple tracking of all transactions, a history feature should be added. It will store incoming and outgoing transactions as well as received and sent invoices.

These are essential features required for this type of apps. And we recommend not overload the app with unnecessary features at first. The more features you want in your app from the start, the higher in-house or outsource app development cost will be.

Important Steps in P2P App Development

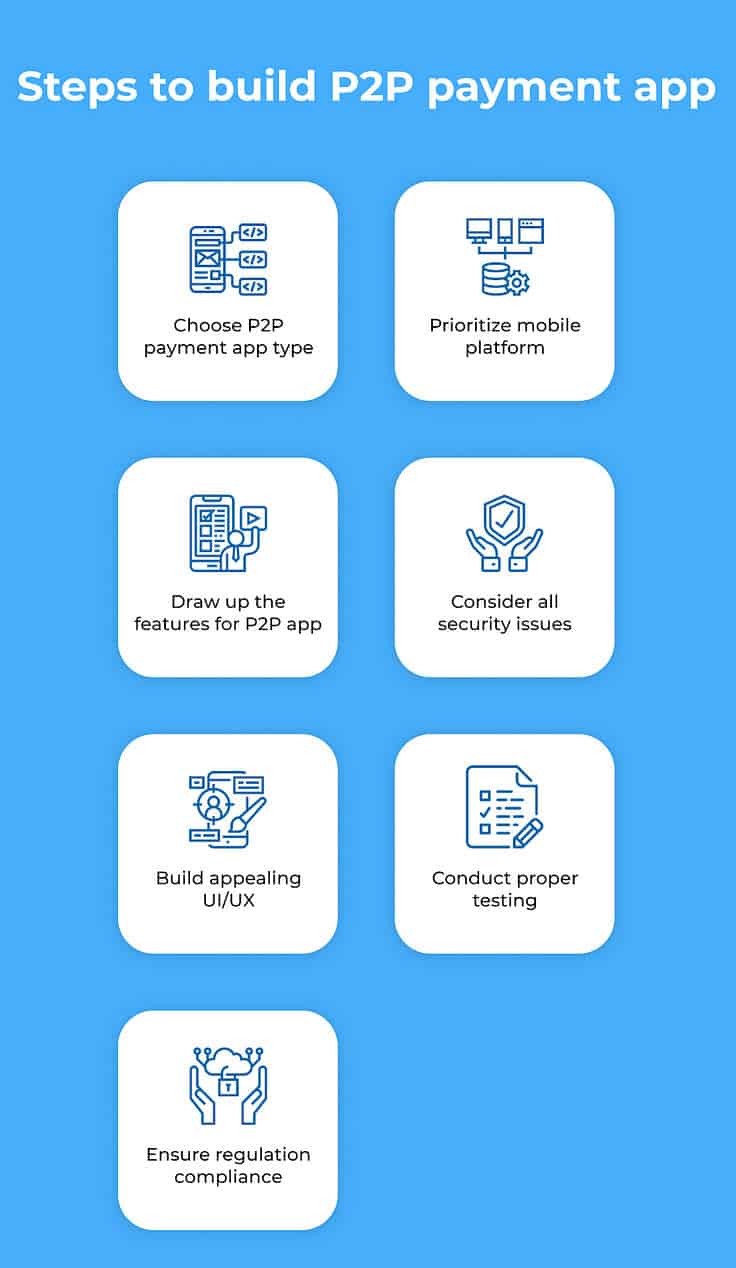

P2P app development is a tricky process and to not get lost, we’ve prepared a step-by-step guide for you.

Step #1. Choose Your App Type

First, you need to decide on the type of attachment you want to create. We already talked about them at the beginning of the article, you just need to make a choice that suits your business goals and needs.

Step #2. Make a Mobile Platform a Top Priority

If you are tight on budget, you can focus your app development on a specific platform like iOS or Android.

Step #3. Make a Feature List

Decide what features your application will include. In addition, it is worth taking care of additional features that will distinguish your app from competitors.

Step #4. Keep in Mind Security Measures

Since you are dealing with your customers’ money don’t forget to make your app as secure as possible. Implement these measures:

- Fingerprint scanner, face recognition

- Two-factor authentication

- PCI-DSS compliance

Step #5. Make Your App User-Friendly

Keep the balance when creating your app’s design. It must be eye-appealing and user-friendly at the same time to gain the audience.

Step #6. Quality Assurance Is Everything

Without proper QA testings, it’s impossible to roll out flawless software products. You need to make sure that the app is working as intended and future users don’t face any bugs or malfunctions.

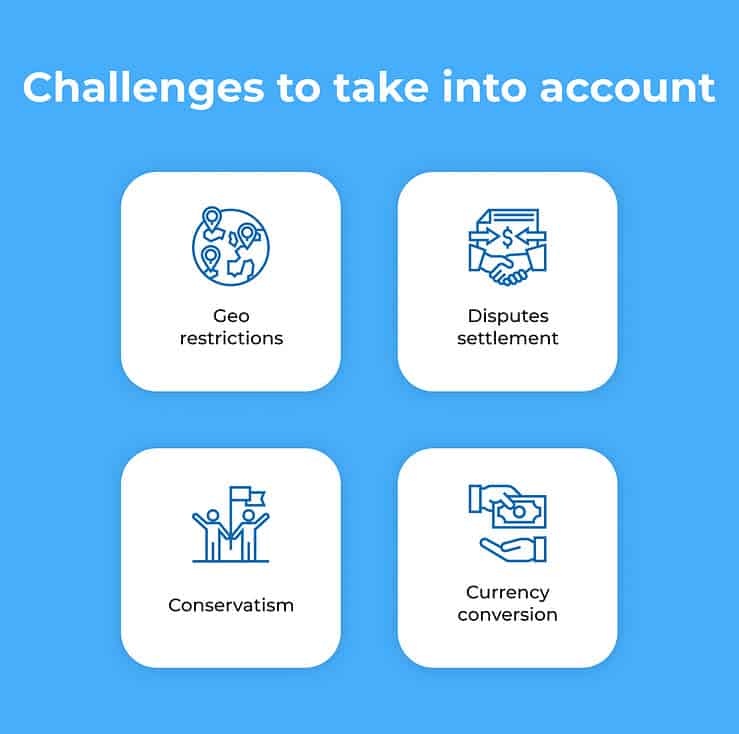

Main Challenges of P2P App Development

First of all, the main challenge in P2P payment app development is legal compliance. Different countries have their own different set of rules that you must obey. Here are few examples.

- Asia and Pacific region. If you want to launch your app in this region, you receive approval from the FinTech Committee under the People’s Bank of China, FinTech Center under the Financial Services Commission (Korea), and Innovation Hub by the Australian Securities and Investments Commission (Australia)

- The United States of America. The compliances may vary from state to state, and if you want to enter the American market, you must be compliant with all 50 states.

- European Union. Your app must be compliant with Directive (EU) 2015/2366.

- The United Kingdom. This region is under the control of the Financial Conduct Authority.

Besides various compliance’s, dispute settlement can become your main headache. Even in the best applications, there can be hiccups with transactions, and while the sender has already sent the required amount, the recipient has not received it. Such situations require immediate solutions. To do this, it is strictly necessary to have support, which will also take up a substantial part of your budget.

Currency conversion is also a tricky challenge, and dealing with all 160 world currencies can become a serious challenge for you. You can try to implement a real-time currency converter to stand out from competitors and bring value to your users.

Wrapping Up

As you can see, P2P payment app development is a tricky process that requires special preparation. You need to think through many things before you can start the development process. But now you are armed with knowledge and ready to start your own Peer-to-Peer app development.

Author’s bio:

Vitaly Kuprenko is a technical writer at Cleveroad, a web and mobile app development company in Ukraine. He enjoys writing about tech innovations and digital ways to boost businesses.